The 2026 UK Home Report: The "Quality Over Quantity" Shift for Home Furnishing & Tech

The 2026 UK Home Report: The "Quality Over Quantity" Shift for Home Furnishing & Tech

Friday, January 9, 2026

Oli Yeates

Oli Yeates

CEO & Founder

CEO & Founder

If the first few weeks of 2026 have taught us anything, it is that the "new normal" is actually just a constant state of evolution. We have seen the digital landscape shift dramatically over the last twelve months, and nowhere is this more apparent than in how we invest in our own four walls.

We have taken a deep dive into the latest consumer insights to understand exactly where UK households are putting their money this year. The headline? We are seeing a fascinating tug-of-war between financial caution and a desire for high-quality, tech-enabled living.

Here is what you need to know about the consumer spending landscape for home furnishing and technology in 2026.

The "Quality Over Quantity" Shift

The economic headwinds of the mid-2020s have left a lasting mark on buyer psychology. While inflation has stabilised, the "spend it while you have it" mentality has been replaced by a more calculated approach.

According to recent data from KPMG's consumer insights, nearly half of consumers (49%) say they are cutting back on general discretionary spending in early 2026. However, this does not mean the wallet is shut tight. Instead, we are seeing a "flight to quality."

Consumers are deferring impulse buys but are still willing to commit to big-ticket items if the value proposition is undeniable. In the home furnishing sector, this translates to a demand for durability. Shoppers are asking: "Will this sofa last ten years?" rather than "Does this match the current micro-trend?"

Furnishing Trends: Curves, Comfort, and "Industrial Luxe"

Despite the cautious backdrop, the UK furniture market is forecast to outperform non-food retail through 2029, with a predicted growth of 10% between now and 2029 GlobalData.

So, what are people actually buying?

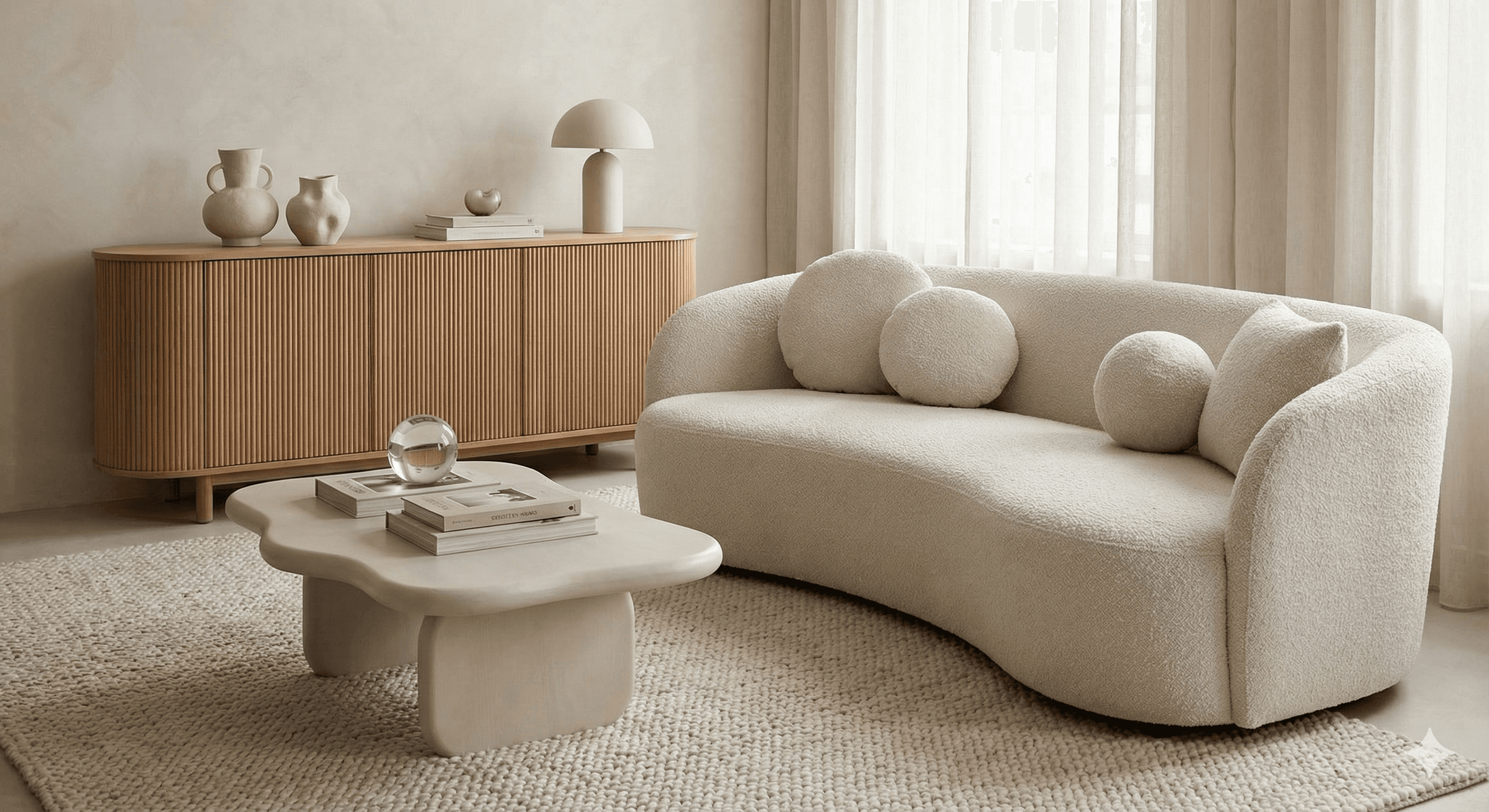

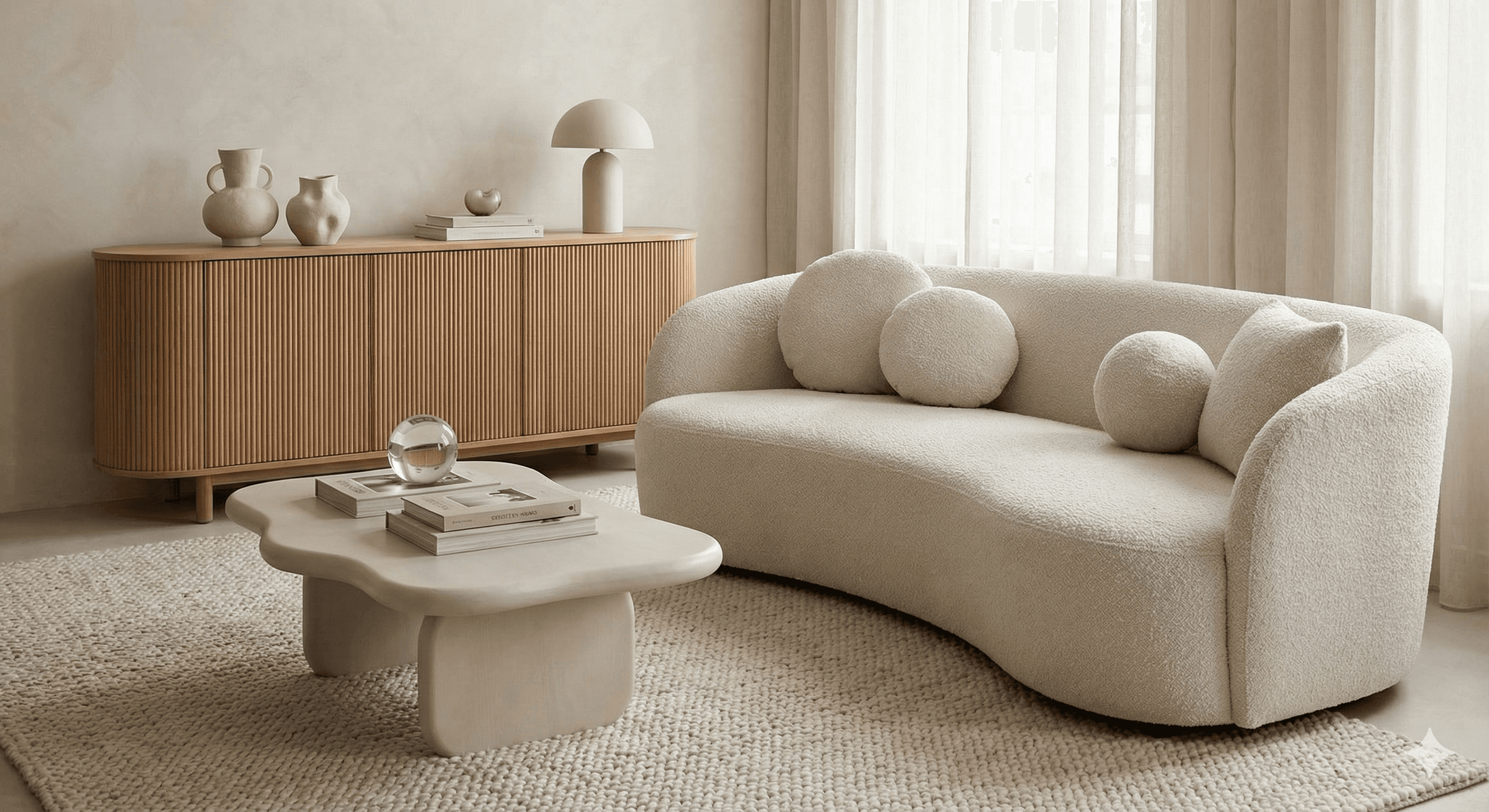

The Return of "Industrial Luxe": We are seeing a move away from stark minimalism towards a blend of raw materials and refined finishes. Think metallic-edged marble tables paired with plush velvet seating. It is about balancing authenticity with comfort.

Soft, Organic Shapes: The sharp lines of the early 2020s are being smoothed out. Curved sofas and "fluted" furniture are proving popular as they add character and softness to living spaces.

Sustainability as Standard: This is no longer a "nice-to-have" marketing angle; it is a baseline expectation. 63% of retail buyers now prioritise suppliers with strong sustainability credentials Retail Week. If your product doesn't have an eco-story, it is likely being left on the shelf.

Home Tech: From "Smart" to "Intelligent"

In the technology sector, the story is slightly different. Global sales for consumer tech are expected to remain flat or see a slight decline of -0.4% in 2026 NIQ.

The reason? Market saturation. Most UK homes are already full of smart devices. The spending driver in 2026 is not about more tech, but smarter tech.

The Replacement Cycle: A significant portion of 2026 spending is driven by necessity rather than novelty. For instance, the end of support for older operating systems like Windows 10 is forcing a wave of laptop and PC upgrades.

Visual Dominance: We are seeing a surge in "super-size" screens, with 100-inch+ Mini-LED TVs becoming a realistic option for mainstream living rooms as manufacturing costs drop.

Wellness Tech: The integration of health monitoring into home goods is a key growth area. Smart mattresses that analyse sleep patterns and smart mirrors that monitor health metrics are moving from niche gadgets to desirable home additions.

What This Means for Brands

For marketers in the property and home sector, the message is clear. You cannot rely on low prices or flash sales alone to move the needle.

1. Sell the Long Game

Your marketing needs to emphasise longevity and build quality. In a year where 42% of consumers plan no big-ticket spending in Q1 KPMG, you need to prove why your product is an investment, not a cost.

2. Focus on "Value" (Not Just Price)

Value in 2026 means functionality, durability, and ethics wrapped into one. Consumers are happy to pay a premium, but only if they can clearly see where that extra money is going.

3. Leverage Visual AI

With visual standards rising (thanks to those 100-inch TVs), your digital assets need to be flawless. We have been doing some incredible work recently with AI-driven visual tools to help home brands create high-fidelity, localised campaign assets without the cost of physical shoots.

The consumer of 2026 is savvy, cautious, but ultimately ready to invest in their sanctuary. The brands that win this year will be the ones that respect the customer's intelligence and offer genuine, lasting value.

If the first few weeks of 2026 have taught us anything, it is that the "new normal" is actually just a constant state of evolution. We have seen the digital landscape shift dramatically over the last twelve months, and nowhere is this more apparent than in how we invest in our own four walls.

We have taken a deep dive into the latest consumer insights to understand exactly where UK households are putting their money this year. The headline? We are seeing a fascinating tug-of-war between financial caution and a desire for high-quality, tech-enabled living.

Here is what you need to know about the consumer spending landscape for home furnishing and technology in 2026.

The "Quality Over Quantity" Shift

The economic headwinds of the mid-2020s have left a lasting mark on buyer psychology. While inflation has stabilised, the "spend it while you have it" mentality has been replaced by a more calculated approach.

According to recent data from KPMG's consumer insights, nearly half of consumers (49%) say they are cutting back on general discretionary spending in early 2026. However, this does not mean the wallet is shut tight. Instead, we are seeing a "flight to quality."

Consumers are deferring impulse buys but are still willing to commit to big-ticket items if the value proposition is undeniable. In the home furnishing sector, this translates to a demand for durability. Shoppers are asking: "Will this sofa last ten years?" rather than "Does this match the current micro-trend?"

Furnishing Trends: Curves, Comfort, and "Industrial Luxe"

Despite the cautious backdrop, the UK furniture market is forecast to outperform non-food retail through 2029, with a predicted growth of 10% between now and 2029 GlobalData.

So, what are people actually buying?

The Return of "Industrial Luxe": We are seeing a move away from stark minimalism towards a blend of raw materials and refined finishes. Think metallic-edged marble tables paired with plush velvet seating. It is about balancing authenticity with comfort.

Soft, Organic Shapes: The sharp lines of the early 2020s are being smoothed out. Curved sofas and "fluted" furniture are proving popular as they add character and softness to living spaces.

Sustainability as Standard: This is no longer a "nice-to-have" marketing angle; it is a baseline expectation. 63% of retail buyers now prioritise suppliers with strong sustainability credentials Retail Week. If your product doesn't have an eco-story, it is likely being left on the shelf.

Home Tech: From "Smart" to "Intelligent"

In the technology sector, the story is slightly different. Global sales for consumer tech are expected to remain flat or see a slight decline of -0.4% in 2026 NIQ.

The reason? Market saturation. Most UK homes are already full of smart devices. The spending driver in 2026 is not about more tech, but smarter tech.

The Replacement Cycle: A significant portion of 2026 spending is driven by necessity rather than novelty. For instance, the end of support for older operating systems like Windows 10 is forcing a wave of laptop and PC upgrades.

Visual Dominance: We are seeing a surge in "super-size" screens, with 100-inch+ Mini-LED TVs becoming a realistic option for mainstream living rooms as manufacturing costs drop.

Wellness Tech: The integration of health monitoring into home goods is a key growth area. Smart mattresses that analyse sleep patterns and smart mirrors that monitor health metrics are moving from niche gadgets to desirable home additions.

What This Means for Brands

For marketers in the property and home sector, the message is clear. You cannot rely on low prices or flash sales alone to move the needle.

1. Sell the Long Game

Your marketing needs to emphasise longevity and build quality. In a year where 42% of consumers plan no big-ticket spending in Q1 KPMG, you need to prove why your product is an investment, not a cost.

2. Focus on "Value" (Not Just Price)

Value in 2026 means functionality, durability, and ethics wrapped into one. Consumers are happy to pay a premium, but only if they can clearly see where that extra money is going.

3. Leverage Visual AI

With visual standards rising (thanks to those 100-inch TVs), your digital assets need to be flawless. We have been doing some incredible work recently with AI-driven visual tools to help home brands create high-fidelity, localised campaign assets without the cost of physical shoots.

The consumer of 2026 is savvy, cautious, but ultimately ready to invest in their sanctuary. The brands that win this year will be the ones that respect the customer's intelligence and offer genuine, lasting value.

more BLogs

more BLogs